Motor insurance premiums are set to be based on a list of risk factors after the de-tariffing of the industry in 2016, Bank Negara Malaysia (BNM) has said, according to a report by The Sun.

Various risk factors not included in the current motor tariff, such as residence location, vehicle make and model, use of vehicle, occupation of owner, claims history, gender and age will be taken into consideration, similar to the system employed in countries like the UK.

In other words, the insurance premium rates you pay will depend on how much perceived risk you carry - for instance, owners of makes and models with high reported theft rates, owners of high-performance vehicles, owners with fewer years of driving experience or those who live in crime-prone areas will have to pay higher premiums.

The central bank told the daily that it is working together with motor insurance players to come up with a de-tariffing roadmap that will see a more risk-based pricing of premiums.

"As motor insurance is a compulsory cover, it is important that the de-tariffication approach does not significantly impact the motoring public and disrupt access to cover," BNM told The Sun, adding that just adjusting premiums in proportion with increasing motor insurance claims was not sustainable in the long term.

Indeed, according to the General Insurance Association of Malaysia (PIAM), in 2013, motor insurers paid out nearly RM1.3 billion in third-party bodily injuries (+12% over 2012), RM295 million in third-party property damage (+28%) and RM627 million in total for motor thefts (+21% over 2012).

That was last year. This year, in the first quarter alone, net claims paid out for bodily injury and property damage due to road accidents amounted to RM1.384 billion. Clearly, these contribute huge losses to motor insurers.

As such, the insurance and transport industries, along with motorists and other relevant agencies, should work together to promote safer driving, reduce accident rates and create greater awareness on road safety, BNM told The Sun, pointing out that in doing so, insurance payouts can potentially be minimised, leading eventually to lower premium rates.

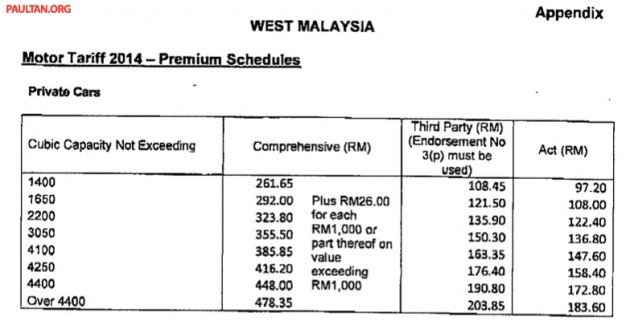

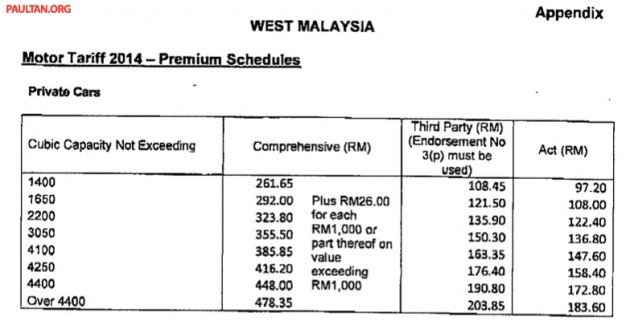

In 2011, the central bank announced the New Motor Cover Framework. Under this framework, Malaysia's motor tariff premiums would be revised gradually beginning January 2012, to eventually culminate in the abolition of tariffs in 2016. Premium rates will then depend entirely on market forces.

Meanwhile, all general insurance products purchased, including motor cover, will be subject to the Goods and Services Tax from April 1, 2015, BNM said.

No comments:

Post a Comment